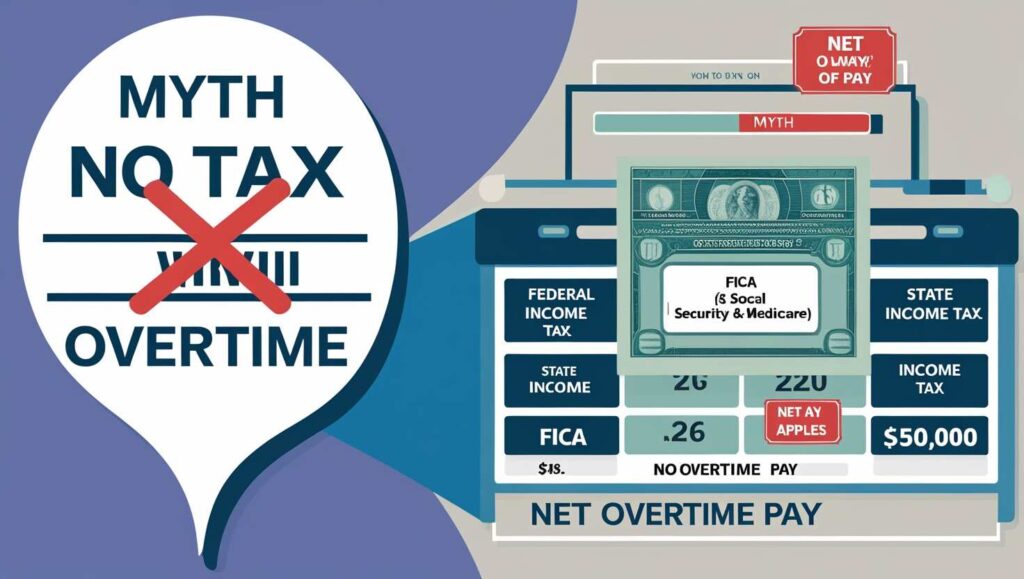

Is there really No tax on overtime? We debunk this common myth and explain how overtime pay is taxed, and what recent proposals might mean for your earnings. Don’t miss this crucial guide!

Introduction

Have you ever heard the exciting rumor: “There’s No tax on overtime“? It sounds like a dream come true for anyone working extra hours to boost their income. Imagine putting in those demanding extra shifts and keeping every single dollar you earn! Unfortunately, this popular belief is largely a myth. While there might be specific proposals or limited scenarios where tax benefits apply to overtime, it’s crucial to understand the reality of how overtime pay is generally taxed. In the United States, overtime earnings are indeed subject to taxation. This blog post will delve into the truth behind the “No tax on overtime” concept, explain how overtime is typically taxed, and discuss recent developments that might be fueling this misconception.

The Reality: Is There Truly No Tax on Overtime?

The short answer for the vast majority of employees in the U.S. is: No, there is generally tax on overtime. Overtime pay is almost universally considered part of your regular income and is therefore subject to federal income tax, state income tax (where applicable), and FICA taxes (Social Security and Medicare).

This means that if you work extra hours and receive overtime pay, that additional income gets added to your total taxable income for the year. It’s not that overtime is taxed more heavily on its own, but rather that the additional income from overtime can increase your overall taxable income, potentially pushing you into a higher tax bracket for that portion of your earnings.

- Key takeaway for the U.S.: Overtime pay is fully taxable as regular income.

Recent Proposals: The Source of the “No Tax on Overtime” Buzz

The misconception that there’s No tax on overtime has recently gained traction due to specific legislative proposals. For instance, a bill passed by the U.S. House of Representatives in May 2025 proposed a deduction for qualified overtime pay.

- The Proposal: This bill aims to make a portion of overtime pay exempt from federal income tax for tax years 2025-2028. However, it’s not a blanket “no tax” rule. Social Security and Medicare taxes (FICA) would still apply to this income. The proposal also has specific limits, such as up to $12,500 for single filers.

- Status: While it passed the House, for this proposal to become law, it would still need to pass the Senate and be signed by the President. As of now, it’s a proposal, not a universal existing law. This kind of legislative discussion often fuels the “No tax on overtime” myth, as people hear about the idea without realizing its limitations or current legal status.

Why the “No Tax on Overtime” Myth Persists

So, if overtime is generally taxed, why does this misconception circulate? Several factors contribute:

- Withholding Confusion: When you receive a large overtime payment, the amount withheld for taxes might appear disproportionately high compared to your regular pay. This is often because payroll systems use a “supplemental wage” method for calculating withholding on irregular payments, or because the additional income pushes you into a higher marginal tax bracket for that pay period, leading to higher tax deductions. It’s not that the overtime itself is taxed at a higher rate than regular income, but that the total income including overtime means more of your money falls into a higher tax bracket.

- Specific Proposals/Exemptions: As seen with the recent U.S. proposal, there are sometimes discussions or even temporary legislative changes aimed at providing tax relief on overtime. These specific, limited initiatives can be misinterpreted as a universal rule of “No tax on overtime.”

- Desire for More Take-Home Pay: Workers naturally want to maximize their earnings from hard work. The idea of keeping all overtime pay is very appealing, leading to the hope that such a rule exists.

Understanding Marginal Tax Rates and Overtime

It’s crucial to distinguish between your average tax rate and your marginal tax rate.

- Average Tax Rate: Total tax paid divided by total taxable income.

- Marginal Tax Rate: The tax rate applied to the last dollar you earn.

When you work overtime, that extra income is added to your existing income. If this additional income pushes you into a higher tax bracket, then the portion of your income that falls into that new, higher bracket will be taxed at that higher marginal rate. This can feel like your overtime is being taxed more, even though it’s simply the progressive nature of the U.S. tax system at play.

For example, if your annual income before overtime is $50,000, and you earn an extra $5,000 in overtime, your total income becomes $55,000. That additional $5,000 will be taxed at the marginal rate of the bracket your income now falls into. For instance, if the bracket for $50,000-$55,000 is 22%, then that additional $5,000 will be taxed at 22%, even if your overall average tax rate is lower.

Conclusion

The notion of “No tax on overtime explained” often leads to disappointment when paychecks arrive. While the idea is appealing, the reality in the U.S. is that overtime pay is almost always subject to federal income tax, state income tax, and FICA deductions. Understanding how your extra earnings are taxed, and being aware of the progressive U.S. tax system, is essential for accurate financial planning. Don’t fall for misleading rumors; instead, empower yourself with accurate information to make the most of your hard-earned income.

Also Read

- 4Xtra Rapper: Age, Net Worth, and Everything You Want to Know!

- Unbelievable! Oasis Confirms Oasis Tour 2025 Los Angeles Dates!

External Links:

- IRS Official Website (for definitive tax information): https://www.irs.gov/

- U.S. Department of Labor (for federal overtime pay rules): https://www.dol.gov/agencies/whd/overtime